How much influence does the Chinese economy has on the US stock market? Coronavirus has closed Chinese borders and air connections with the US and many other countries earlier this year. It is still unclear how long this quarantine will last. In this paper, I will analyze the significance of this closure on the US stock market. How will the US stock market perform if the boarder with China continues to be closed?

First, let’s take a look at how much trade is done between the US and China. Based on 2018 data, the US exported about $120 billion worth of goods to China and imported about $563 billion from China (WITS data). I will add these two numbers together to calculate the total trade value between the US and China. The total trade was worth $683 billion in 2018 (see Table 1). Alone, this total trade value appears significant. However, we need to compare it to the size of the total revenue generated by the US companies. This relative comparison will help us understand the significance of the US-China trade and its possible effect on the US stock market.

(Table 1. Total Trade between the US and China in 2018)

As the proxy to the US Stock market, I will use companies within the S&P500 index (SPX). It is a broad index of 500 large companies in the US. Next, I will calculate the total revenue of these 500 companies. I will use the SPX data to derive the revenue. Revenue is equal to the sales per share multiplied by the total number of shares. The total revenue was equal to $11,604 billion US dollars in 2019 (see Table 2).

(Table 2. Revenue of companies in the S&P500 index, data provided by Yahoo Finance, S&P Dow Jones Indices, and Bloomberg).

(Table 2. Revenue of companies in the S&P500 index, data provided by Yahoo Finance, S&P Dow Jones Indices, and Bloomberg).Now we have both the total trade value between the US and China and the total revenue of the US companies. Next, we can compare these two numbers. The total revenue of the US companies is much greater than the trade value between the US and China (see table 3).

(Table 3. Revenue of the US companies vs. trade value between the US and China)

(Table 3. Revenue of the US companies vs. trade value between the US and China)For visual comparison I will create two pie charts. The first pie chart is in the US Dollar terms (see Chart 1). In absolute terms, $683 billion trade value sounds important. However, the pie chart visually shows much greater amount of revenue earned vs the trade volume between China and the US.

(Chart 1. Revenue of the US Companies vs. Trade Value Between the US and China in US Dollar Terms).

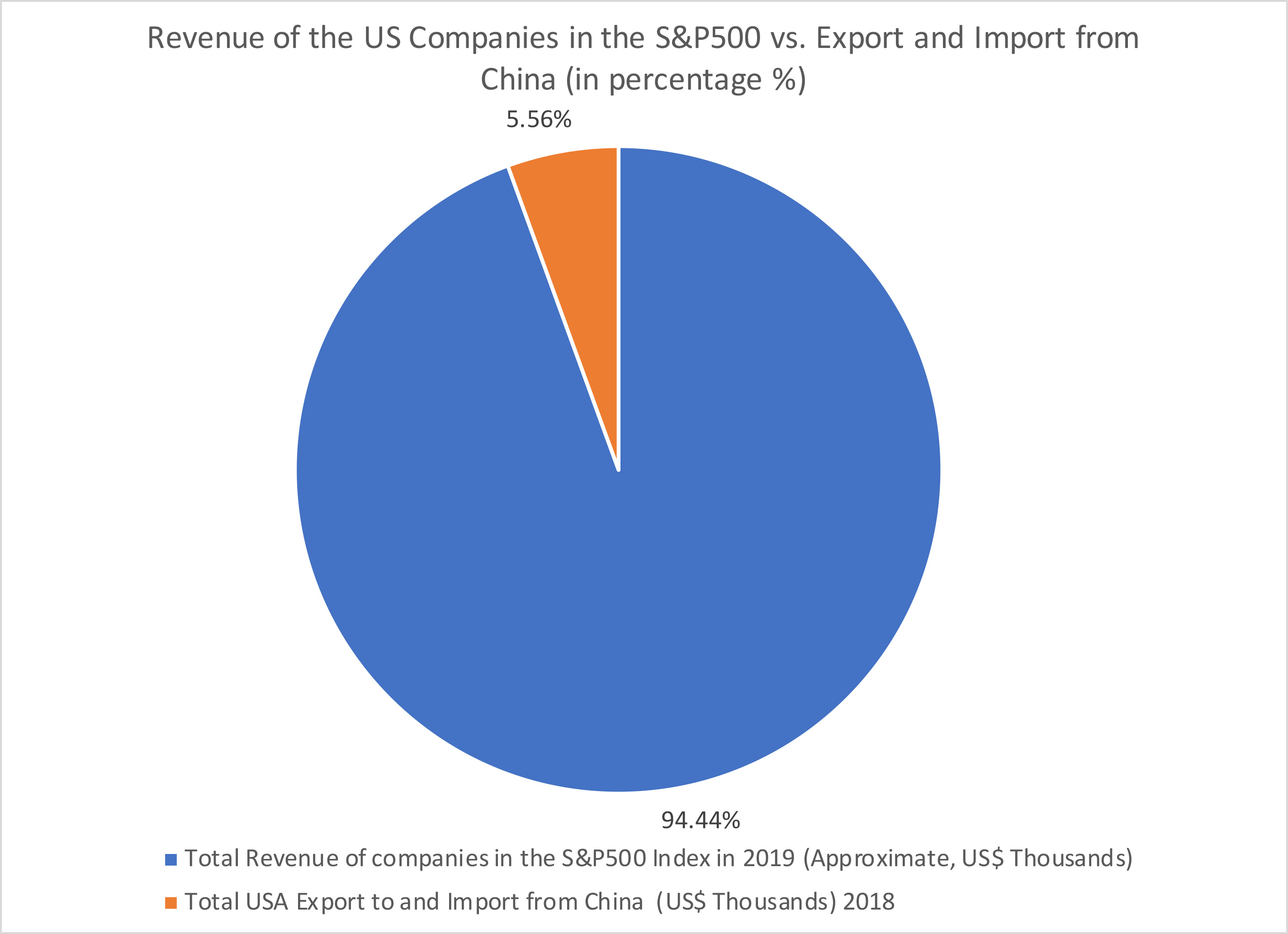

(Chart 1. Revenue of the US Companies vs. Trade Value Between the US and China in US Dollar Terms).For easier comparison, let’s convert US Dollars into % percentage terms. The total trade value between the US and China was only 5.56% vs. 94.44% the total revenue of the US companies (see Chart 2). Even though, the trade between the US and China is large in absolute terms, it is relatively small in percentage terms when compared to the US companies’ revenue. This comparison shows limited influence of closed Chinese economy on the US stock market. The US companies do not rely on trade with China as much as it may appear. The significance of China is to produce low cost products to be sold in the US and the rest of the world. Physical boarder and air space closure between the US and China should have a small effect on the overall US stock market in the long run. In the short run, disruptions to the production and supply chain may have negative effect on revenues and profits of US firms.

(Chart 2. Revenue of the US Companies vs. Trade Value Between the US and China in relative percentage % terms).

(Chart 2. Revenue of the US Companies vs. Trade Value Between the US and China in relative percentage % terms).Data:

The World Integrated Trade Solution (WITS) Data accessed on Feb 8, 2020.

https://wits.worldbank.org/CountryProfile/en/Country/USA/Year/2018/TradeFlow/EXPIMP

Yahoo! Finance Data accessed on Feb 8, 2020. https://finance.yahoo.com/quote/%5EGSPC/history?p=%5EGSPC

S&P Dow Jones Indices Data accessed on Feb 8, 2020. https://us.spindices.com/indices/equity/sp-500

Bloomberg. Data accessed on Feb 8, 2020 https://www.bloomberg.com/quote/SPX:IND

Disclosures:

The analysis of China-US trade is based on data from the year 2018, future reality may be different from historical results. This analysis is limited and does not include indirect influence of Chinese economy on other trading partners; such as, Europe and Asia Pacific Region. Some companies may have significant exposure to China and depend on it for its goods and services production. This paper was written as an opinion only. The data is not guaranteed to be accurate or complete. Please consult with your financial advisor and accountant before making an investment decision.

ECNFIN.com is not associated with nor does it necessarily represent the opinion or advice of Culver Investment Company LLC. Past performance doesn’t guarantee future results.

Never miss an episode

Subscribe wherever you enjoy podcasts:

Our Mailing Address:

ECNFIN

1312 17th Street

Unit #2991

Denver, CO 80202

Our Fax:

+1 720-790-7606

Our Mailing Address:

ECNFIN

1312 17th Street

Unit #2991

Denver, CO 80202

Our Fax:

+1 720-790-7606

Leave a comment